If Your Skin Looks Like This, Here’s What It May Really Mean

Goosebumps on your skin can reveal surprising body reactions.

Goosebumps on your skin can reveal surprising body reactions.

Some experts say leaving a key in the door may improve safety.

Some vegetables may harm liver health if eaten improperly.

Beer and Salt: The Little-Known Home Trick That Can Be Surprisingly Useful

Why Some People Put Ginger Next to Their Pillow at Night?

6 Types of People Who Should Not Eat Oysters

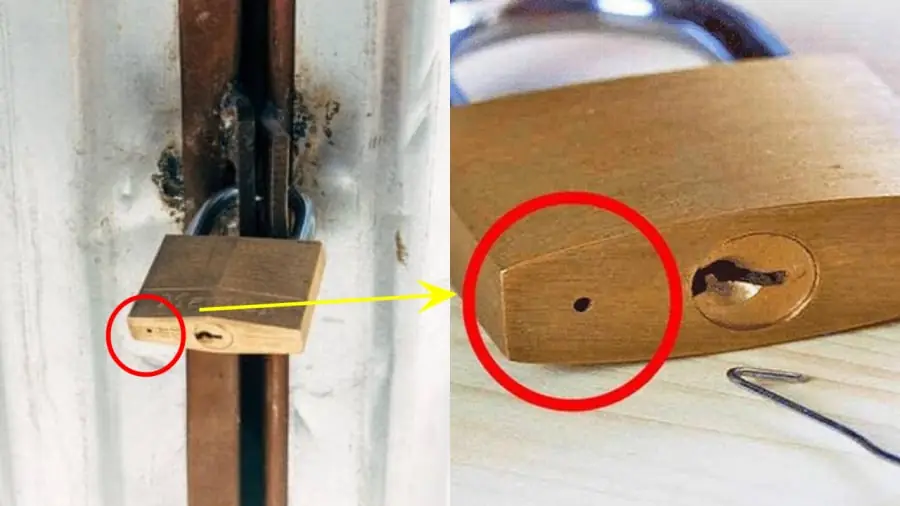

The Little Hole on the Bottom of a Lock: What Is It Actually Used For?

Dark Chocolate and Your Health: What Happens When You Eat It Often

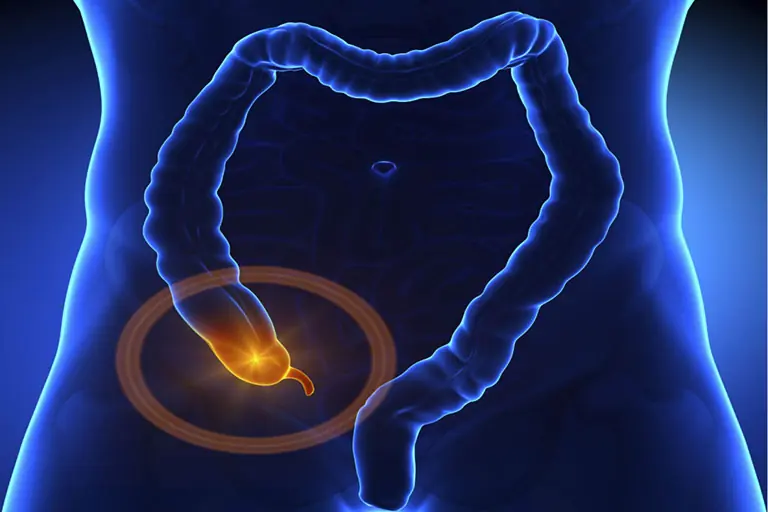

5 Early Signs of Appen.dicitis You Should Pay Attention To

What Happens When Men Eat Ginger First Thing in the Morning?

Do You Get Leg Cramps at Night? Here’s What Causes Them and How to Find Relief

Papaya Seeds: Tiny Seeds With Big Health Benefits

5 Strange Changes in Your Feet That May Be Linked to Kidney Issues

15 Possible Early Symptoms of Lung Can.cer

Think Before You Wash: 3 Times Experts Say You Should Avoid It

Morning Dry Mouth: 6 Causes and 7 Effective Solutions

Doctors Reveal 10 Common Reasons for a Bitter Taste in Your Mouth

20 Little-Known Benefits of Okra Water for Everyday Wellness

The Importance of Beans in Controlling Diabetes.

3 Fruits That Support Liver Health and Control Sugar and Cholesterol