Parents want the best for their kids. But this doesn’t always mean the little ones get top-quality clothes, the latest toys, or the coolest gadgets. Most likely, it means they want their sprouts to be safe and secure and to have a solid foundation for the days to come. This includes handling money.

“Without a working knowledge of money, it is extraordinarily difficult to do well in life,” Sam X Renick, the co-creator of Sammy Rabbit, a children’s character and financial literacy initiative, told Forbes. “Money is central to transacting life, day-in and day-out. Where we live, what we eat, the clothes we wear, the car we drive, health care, education, child-rearing, gift-giving, vacations, entertainment, heat, air-conditioning, insurance—you name it, money is involved.”

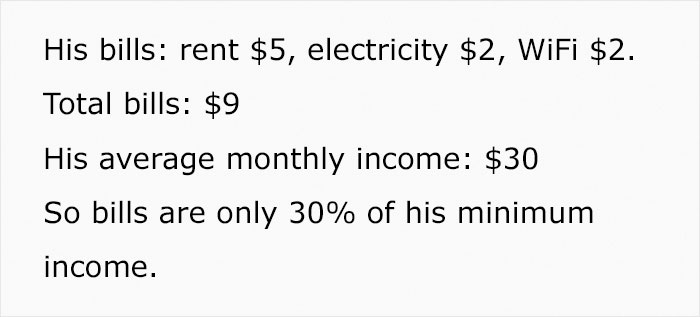

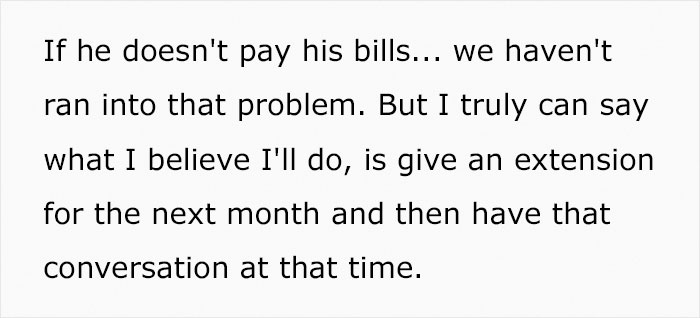

Recently, a mom from Florida has gone viral after she posted a TikTok with a “parenting hack” that has been “extremely successful” in teaching her 7-year-old this lesson.

Image credits: craftedandcozy

Image credits: craftedandcozy

A month ago, we at Bored Panda published a similar piece, only that one was about a 16-year-old. Talya Stone, who is a former editor-in-chief turned parenting blogger and the woman behind Motherhood: The Real Deal and 40 Now What, then told us that kids need to understand money from early on. However, every child is different and each parent needs to cater their approach accordingly.

To help the little ones get started, Stone suggested giving them pocket money and their own wallet from a fairly young age. “Tell them to bring it along on days out, and holidays, and pay for small bits and bobs they want for themselves even if it’s just a bar of chocolate,” she said. “I think I started doing this with my daughter when she was five but this could even be done before. Understanding money, how much things cost, spending power, and how to save is a vital life skill. If your child wants a new toy, instead of buying it for them every time on demand, you can encourage them to save towards it and tell them you will pay for half so long as they do, for instance. This has never been so important in the increasingly materialistic world we live in.”

Image credits: craftedandcozy

Parents should continue teaching their kids about the different aspects of money as they grow older. “Other things to do is take them along to the bank with you and set up a bank account in their name from a young age and have them deposit some of their pocket money in there,” Talya Stone added. “Talk to them about how much things cost when you are in the shops or buying online. Talk to them about what you earn or how much a family holiday or day out costs. We shouldn’t shy away from these things or be embarrassed by them. Open, age-appropriate communication around these things as with other things in parenting is vital. You can also ask to borrow money from them – a dollar here and there – and pay it back so they understand this concept too.”

As they become older, parents can also show their kids case studies of young adults who are both managing money well as well as sharing stories of those in debt.

Equally, as parents lead by example, they should talk and explain how they manage the family’s money and try not to spoil their children with material goods too much.

@craftedandcozyThis has worked wonders in my household….hope it works for you!