Getting financially fit can be a huge task—or not, depending on your spending style. Either way, a little help certainly couldn’t hurt. Here’s a list of some of our fave apps to guide your spending and financial planning.

Credit Monitoring Convenience

Getting your finances in order will likely lead to better credit. Several sites can monitor your credit, and some will give you a free copy of your credit report, but Mint lets you monitor your budget while monitoring your credit at the same time. It’s like one-stop shopping! And all for free! Just connect your accounts, and Mint will send alerts when any suspicious activity occurs or when you’ve overspent in a particular category within your budget.

If You Like Free and Simple

There’s nothing like ‘free’ to appeal to a person’s frugal sensibilities. In addition to being free, Pocketguard offers you a simplified big picture of your finances by connecting your checking, credit, and savings accounts. It categorizes your expenses and gives you the option to customize and create personalized categories with individual spending limits. The app can track any recurring payments and upcoming bills, so you know at a glance what’s available for you to spend that day.

For the Zero-Based Budgeters

This method isn’t for everyone since not everyone can handle the strict budgeting format. Zero-based budgeting means you end the month with a balance of ‘0’. It’s extremely accurate and efficient, analyzing each dollar spent to ensure it’s going to a justified expense. Apps like You Need A Budget (YNAB) and EveryDollar are popular, but both require subscriptions unless you opt for their limited free trials.

Once that trial period is over, you can sign up for a yearly subscription offered by both sites or go for the monthly service at YNAB instead. Each one gives you the basic tools that free apps like Pocketguard give you, but the paid subscription also gets you additional resources like free workshops and budgeting advice.

Stay out of Sync

Not everyone is comfortable just filling out information about their bank accounts and jettisoning it into the ether of the world wide web. That web can get pretty tangled, and nasty things can happen when the wrong hands get a hold of your secure info. Thankfully, you can protect yourself while still enjoying the convenience of a good budgeting app.

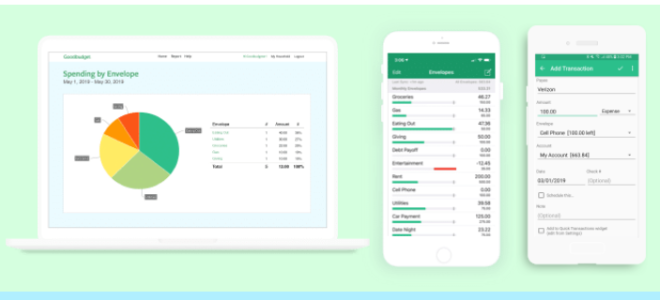

Try Goodbudget, where you can manually input account balances and income without syncing all your accounts. You can then assign amounts to different categories or “envelopes” and share this budget with others who can log in from different devices. Great for families who need to stay within their allotted spending limits. Goodbudget offers a free account, but a paid subscription gives you additional perks, such as the ability to create unlimited envelopes and additional access for up to five devices.

Couples on a Budget

Money can be a source of conflict for lots of couples. While we can’t solve any personal problems with the significant other, we have a suggestion that may help ease some of that tension. Keep track of your finances together with Honeydue. Honeydue sends alerts when upcoming payments are looming and gives you the ability to chat and send emojis so you can remind each other to stay on track. Decide on monthly limits and even get alerts when you or your partner is getting close to reaching it. It’s free to use, so the only other investment is your time and maybe your sanity.

Track Wealth and Spending

If you’ve already used these apps to get yourself on track, maybe you now have some scratch saved and invested. Keep an eye on it with Personal Capital. This app tracks your net worth by connecting your retirement accounts, loans, and mortgages, but it also offers budgeting tools. Commit to increasing your wealth by taking advantage of this free app. (Remember what we told you about ‘free?’)

There you have it. We know money doesn’t make the world go-’round, but it may give you some peace of mind knowing you can at least pay the bills. And that’s gotta be worth something when there’s so much else in this world that we can’t control.

Share this article

Source link : https://www.doityourself.com/stry/7-budgeting-tools-to-get-financially-fit