Bottles from a Hanyu Ichiro “Full Card Series” sold at Bonhams in 2020. Courtesy Bonhams

Bottles from a Hanyu Ichiro “Full Card Series” sold at Bonhams in 2020. Courtesy Bonhams

It was a scene familiar to followers of art auctions: a room full of bidders and buzz, with prospects high and a wealth of distinguished offerings from a seller who chose to keep his identity cloaked.

The sale started with a bang, early offerings going for two or three times their presale estimates. But when the highest-profile lot came under the gavel, the energy pitched up further as bids batted back and forth. Pledges prior to the sale had already pushed the price above the estimate, and a strategic decision on the house’s part to keep that estimate low in the hopes of sparking a bidding war proved shrewd. “We had loads of bidders and loads of action,” said Jonny Fowle, a Sotheby’s specialist who was instrumental in drumming up all the excitement.

As the price rose, murmurs in the room gave way to cheers, first when it became clear that the £1 million threshold (at the time, in 2019, around $1.3 million) would be eclipsed, and then again when the hammer fell on a sale of £1.45 million ($1.9 million, inclusive of standard auction house fees), nearly four times the lot’s high estimate and a new record in a growing category.

The subject of the 10-minute bidding war was not a painting or a sculpture but a bottle of highly coveted and exceedingly rare single-malt whiskey. Other bottles from the same batch dating back to a barrel filled in Scotland in 1926 had broken records around the world—leading to the moment when the buyer of the latest milestone, a collector who had traveled to London for the sale from his home in Taipei, revealed himself bottle in hand in an Instagram post bearing the message: “I am holding 4 Ferrari in my hand… #macallanfineandrare1926 #macallan1926 #mostexpensive #bestofthebest.”

As auction houses in the business of selling art expand their activities in other categories—adding collectibles of various kinds to the more traditional stock of watches, jewelry, and cars—sales of whiskey have garnered new allure. Long a tacked-on addendum to sales of wine and more prestigious spirits like cognac, whiskey has become a dominant force as buyers’ tastes have changed and interest has grown across the globe. Scotch whiskey is at the top of the market, by a considerable measure, but collectors are also paying higher and higher prices for whiskeys from Japan, Ireland, the United States, and Taiwan. And those collectors are responding not just to whiskeys themselves but to the creative and curated ways that distilleries and auction houses are presenting them.

Bottles from a batch of whiskey dating back to a barrel filled in Scotland in 1926 have set records at auction. Courtesy Sotheby’s

Bottles from a batch of whiskey dating back to a barrel filled in Scotland in 1926 have set records at auction. Courtesy Sotheby’s

“This is an area we’ve definitely invested in,” said Jamie Ritchie, worldwide head of wine at Sotheby’s New York. “We’ve seen huge growth of interest in whiskey in the last two years, and we believe that there’s good growth to come. It’s an interesting world—there’s lots of nuance.”

Though Sotheby’s has been selling spirits since 1970, they were traditionally mixed in with wine sales and historically made up less than 1 percent of the house’s Wine & Spirits department’s business. But that ticked up to 6 percent in 2017, Ritchie said, thanks to sales of some valuable bottles of scotch whiskey and Moutai—a brand of Chinese baijiu, a fermented spirit with an expansive range of tastes—at auctions in Hong Kong. “We felt, OK, well, there’s an interesting market to develop here. And we started focusing on it.”

In 2019, Jonny Fowle, based in London, became the first-ever spirits specialist at Sotheby’s, and secured the single-owner consignment auctioned off in “The Ultimate Whisky Collection” sale—the one with the $1.9 million bottle and close to 400 other lots that sold for a combined total of $9.85 million. Spirits sales made up 13 percent of Sotheby’s Wine & Spirits business that year and, in 2020, rose to 19 percent. “It’s a pretty dramatic increase,” Ritchie said.

At Christie’s, wine sales date back to the earliest auctions around the house’s founding in 1766, but spirits have a more sporadic history. Cognac sales were significant in the 1960s and ’70s, and sales dedicated to whiskey were held in Scotland over the years. But whiskey drifted away from Christie’s business until the mid-2000s, when it was resurrected and quickly rose in importance. “There was a surge and we started to see things completely take off in terms of pricing,” said Chris Munro, the head of Christie’s wine department. “The market grew and people saw that collections they had been compiling in the ’90s and early 2000s for relatively no money were now extremely expensive. That brings people into the auction market, like with anything else. Suddenly a bottle of whiskey they paid $500 for is worth $10,000—and it becomes something they want to sell rather than drink.”

In the past few years, prices for the highest-profile lots in Christie’s sales have shot up to six and seven figures—a bottle of Macallan scotch achieved the $1.5 million record in 2018 before the Sotheby’s sale the following year. “The increase has been colossal,” said Munro. “We found that we were attracting more bidders, and that was really being driven by sales outside of Europe, by less-traditional, old-school whiskey collectors. When Hong Kong abolished its import duty on wine in 2008, that led to people also becoming interested in other things. And once you get a number of big cases globally involved, prices can quickly escalate.”

Bonhams, the other major auction house active in the category (in which Phillips, one of the biggest houses for contemporary art, does not participate), holds whiskey auctions in Edinburgh and Hong Kong, where Asian buyers are most active. “As the Far East has come into wine, it has also come into whiskey,” said Richard Harvey, global head of wine for Bonhams. Reiterating the significance of Hong Kong lifting its import duty on wine and thus opening the floodgates (even as import duties on spirits still apply), Harvey said sales there have helped raise prices all over as buyers respond to what they see. “A lot of the demand in the West has been stimulated by prices moving up in the Far East,” he said. “A lot of people are looking at it as an investment to sell on, and the traditional whiskey drinker-collector is to a large extent being priced out of the market.”

Scenes from the 2019 auction at which the bottle of Macallan 1926 sold for a record-setting $1.9 million. Courtesy Sotheby's

Scenes from the 2019 auction at which the bottle of Macallan 1926 sold for a record-setting $1.9 million. Courtesy Sotheby's

“In addition to death, debt, and divorce, we have a fourth D: doctors’ orders,” Ritchie said of extra incentive for certain sellers of rare and vintage whiskeys on the secondary market. But more instrumental than mercy for ailing livers is a long-standing cultivation of collectibility among leading whiskey distilleries with decades of history behind them. “They’ve always been very good curators of small or rare limited offerings and very smart about marketing them,” Ritchie said. “So when rarity strikes and interest is garnered around the world, there’s an inventory of rare items to appreciate in value, whereas that’s just not the case with many other spirits. That is why whiskey is particularly well-positioned, and now the market is appreciating that.”

“The whiskey market does attract a sort of collector mentality, like a coin collector who wants to go out and buy the latest release or a numbered bottle,” said Munro. “If there’s a set of 20, they want all 20. Whiskey collectors are different than wine collectors in that way. It’s a very detail-obsessed collecting category, and it takes a lot of knowledge to know what all the different bottlings are.”

Collectors at the top of the market are also attracted to the allure of certain brands. “It’s similar to watches and cars,” Munro said of other auction categories in which brands like Rolex and Ferrari dominate. “Certain distilleries are more collectible than others, and they’ve been very good at creating new collectible items in their own right, with different bottles and decanters. They’ve become collectible things outside of what’s inside them, in a way.”

At the top of the collectibles market is the Macallan, which beyond record-setting individual bottles at auction has incubated all sorts of ongoing programs and series that aspire to higher and higher levels of luxury status. At Sotheby’s in 2019, the house’s first full year of dedicated spirits-only auctions, the Macallan accounted for 54 percent of all spirits sales by value, with Moutai in second place at 10 percent, followed by Bowmore, Yamazaki, and other whiskey brands. In 2020, the Macallan remained on top, at 38 percent, with fellow scotch brand the Dalmore next, at 20 percent, and the following two slots held by Karuizawa (a Japanese distillery that closed in 2001) and Moutai. While the numbers fluctuate year-over-year as available lots change, Ritchie compared the Macallan’s standing to Romanée-Conti in the realm of French wine, Ornellaia in Italian wine, and Dom Pérignon in champagne. “These are brands that will always be up and around the top, and frequently dominating their categories,” he said.

“One of the ways we did that was to create what we called objets d’art,” said Ken Grier, who guided the rise of the Macallan brand for nearly two decades. “I believe in art as a core differentiator here.”

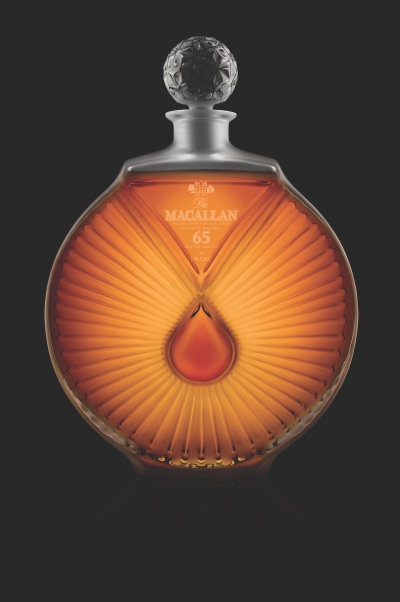

The Macallan in a crystal decanter designed by Lalique Courtesy Macallan

The Macallan in a crystal decanter designed by Lalique Courtesy Macallan

Before he stepped away in 2018 to start De-Still Creative, a consultancy through which he works with other whiskey brands, Grier served in a variety of director roles at the Macallan, and conceived some of its most luxe incarnations. Drawing on past relationships between the Macallan and artists of renown—including British Pop artist Peter Blake and Italian painter Valerio Adami, both of whom designed labels decades ago for a storied line of bottles holding whiskey from 1926—Grier upped the ante. In a partnership he forged with the feted French glassmaking company Lalique, he created custom crystal decanters that have sold at auction for prices as high as $628,000. He also created a Macallan Masters of Photography program comprising collaborations and campaigns shot by celebrated photographers such as Albert Watson, Annie Leibovitz, Mario Testino, and Steven Klein.

Vintage whiskeys from the distillery’s holdings in newly designed bottles and elaborate packaging added extra layers to the legacy. “We saw that there was potential to generate brand salience and incredible connections, and build pieces which were collectible beyond the fact of them being very old,” said Grier, whose work at the Macallan has continued since his departure. In 2020, the brand partnered with Sotheby’s to create a unique set of bottles for its Red Collection series with labels designed by artist Javi Aznarez; they were auctioned for charity in “The Ultimate Whisky Collection Part II” sale this past October, when the six-bottle set went for around $1 million. This past March, the Macallan and Sotheby’s partnered again for a charity sale of a bottle from a new Anecdotes of Ages Collection that features one-of-a-kind, hand-blown glass bottles and labels designed by Peter Blake for vintage whiskey from 1967—the year Blake created the Sgt. Pepper’s Lonely Hearts Club Band album cover for the Beatles. Proceeds from the sale, which brought in $437,500, went to help support initiatives at the Solomon R. Guggenheim Museum aimed at equity, access, and inclusion.

From the brand’s perspective, working with Sotheby’s lends an air of prestige. “The leading auction houses have a meticulous focus on their holistic operations and a wonderful attention to detail in managing their client relationships,” said Geoff Kirk, the Macallan’s head of brand development and private client management. “Most critically, we share a common desire to provide meaningful and valuable experiences with a high level of exclusivity and discretion.”

Though the company’s efforts are focused mainly on the primary market, bottles changing hands at auction has helped cultivate mystique. “Through a continuing sequence of record-breaking auction results,” Kirk added, “the Macallan has proven its industry-leading positioning not only in the single-malt whiskey category but also as a collectible in the same standing as highly sought-after art.”

Sotheby’s has also worked with other brands to develop a kind of uniqueness akin to art. A 2019 collaboration involving the Dalmore’s master distiller and chef Massimo Bottura of Osteria Francescana, one of the world’s most illustrious restaurants, led to the sale of a one-of-one bottle of Dalmore L’Anima whiskey (a blend of three different assemblages) in a Baccarat crystal decanter with a sterling silver stopper, packaged in a handcrafted wooden cabinet of Italian olive, American black walnut, and ebony. Including dinner for two at Bottura’s hotspot in Modena, Italy, the lot sold in 2019 for around $149,000. “That was a real blink-and-you-miss opportunity,” said Fowle, the Sotheby’s specialist. “The only possible occasion that you could have picked up that bottle was at the Sotheby’s auction.”

Grier now works on ever more extensive projects with other scotch whiskey brands including Bowmore, for which he helped conceive a 25-bottle set of vintage whiskey with carmaker Aston Martin, housed in a special vessel fusing glass with metal from a piston from a DB5, the model made famous by James Bond. “Scotch is an art form in its own right,” Grier said, “but the game now in high-end scotch is the combination of the craft of making whiskey, putting a product together in a beautiful way, and then turbo-charging that through aesthetics and story values. That’s where it really ties in with the world of art.”

The Auld Alliance, a storied whiskey bar in Singapore co-owned by Emmanuel Dron. Courtesy Emmanuel Dron

The Auld Alliance, a storied whiskey bar in Singapore co-owned by Emmanuel Dron. Courtesy Emmanuel Dron

“In the past there were a lot of collectors of whiskey. Now there are a lot of investors—and collectors and investors are not the same,” said Emmanuel Dron, the author of Collecting Scotch Whisky: An Illustrated Encyclopedia, Volume 1 and co-owner of the Auld Alliance, a bar in Singapore with more than 1,000 bottles of fine and rare spirts. “The market has gone crazy. Not everybody can drink a vintage Macallan for $50,000—it’s not for everybody. They are luxury items.”

As he has watched whiskeys rise, Dron said he has been looking more and more for other spirits like calvados and cognac—a strategy affirmed by Fowle. “Because the access point for collectible whiskey is so high, people are beginning to explore armagnac, cognac, and rums,” Fowle said. “As younger drinkers may be struggling to get on the whiskey ladder, they’ll explore other dark spirits, so there’s room for more than just whiskey in the collectors’ market right now.”

Still, whiskey predominates. And its status as a luxury item has put it in a league with other categories that auction houses favor. “The real top-dog whiskey buyers tend to have luxury interests,” Fowle said. Among their shared pursuits are watches and cars, he noted, and “more and more these days we see that, at the highest level, these guys are art collectors as well. They do interact with Sotheby’s in a number of categories.”

One collector whose interests are expansive is Jacky Y. Chen, the Taiwanese buyer of the record-setting $1.9 million Macallan from 1926. The bottle he bought is part of the distillery’s Fine & Rare Collection, a roster of dated bottles that offer what promotional materials call “journeys through time.”

Reached on Instagram recently while he was up late bidding in an online auction for cigars and contacted later via a WhatsApp video call, Chen—a 42-year-old entrepreneur whose investments include a 500-branch coffeehouse chain called Louisa based in Taipei—said he started out collecting Chinese antiques before moving on to wine, whiskey, and contemporary art. Among the artists whose works from his collection are pictured on his Instagram account are Eddie Martinez, Yoshitomo Nara, KAWS, and Yayoi Kusama. His Instagram page also depicts other holdings ranging from bottles of vintage champagne to a jar of dried orange peels aged since the 1950s.

Though his interests in art tend toward the “new and now”—a phrase he attributes to the ongoing Phillips “New Now” auction series—Chen said he bought the storied Macallan whiskey, aged for 60 years in a sherry cask before being bottled in 1986, because of its connections to the past. “This is a really important bottle and I believed I should get it, no matter [whether] I’m going to [keep] it for a long time or I’m going to sell it,” he said. “The year 1926 was between World War I and World War II. The economy was so bad, and no one would have known what was going to happen after 60 years. From my point of view, things I collect must represent something about time.”

Chen sips from much of his holdings of whiskey and wine, but he intends for the seal on his Macallan 1926 to stay unbroken for posterity. Asked if he plans to sample the artifact for which he paid $1.9 million, he wagged his finger from side to side. “This is not just whiskey,” he said. “If you buy a Chinese porcelain antique, are you going to use it as a vase? You’re not going to use it, but you could put it in a collection to put in a museum.”

A version of this article appears in the August/September 2021 issue of ARTnews, under the title “Spirits Rising.”

Source link : https://www.artnews.com/art-news/market/whiskey-auction-houses-market-1234605030