During a trip to Dubai last year that, in characteristic pandemic fashion, stretched from a planned two weeks to four months, Ammar Moiz noticed the cool brands he’d become familiar with living in New York were nowhere to be seen. “It was almost like I’d gone back 20 years in the CPG space,” he says. “Everything was pretty much from large conglomerates.”

The observation validated a business theory Moiz, an investor in consumer companies following Congo’s 2018 acquisition of Counselytics, an analytics firm he guided as COO, had that direct-to-consumer brands needed help expanding to international markets. Moiz says, “A lot of the brands have had growth domestically, but international has been pretty far off on the horizon, and that is different from traditional CPG brands.”

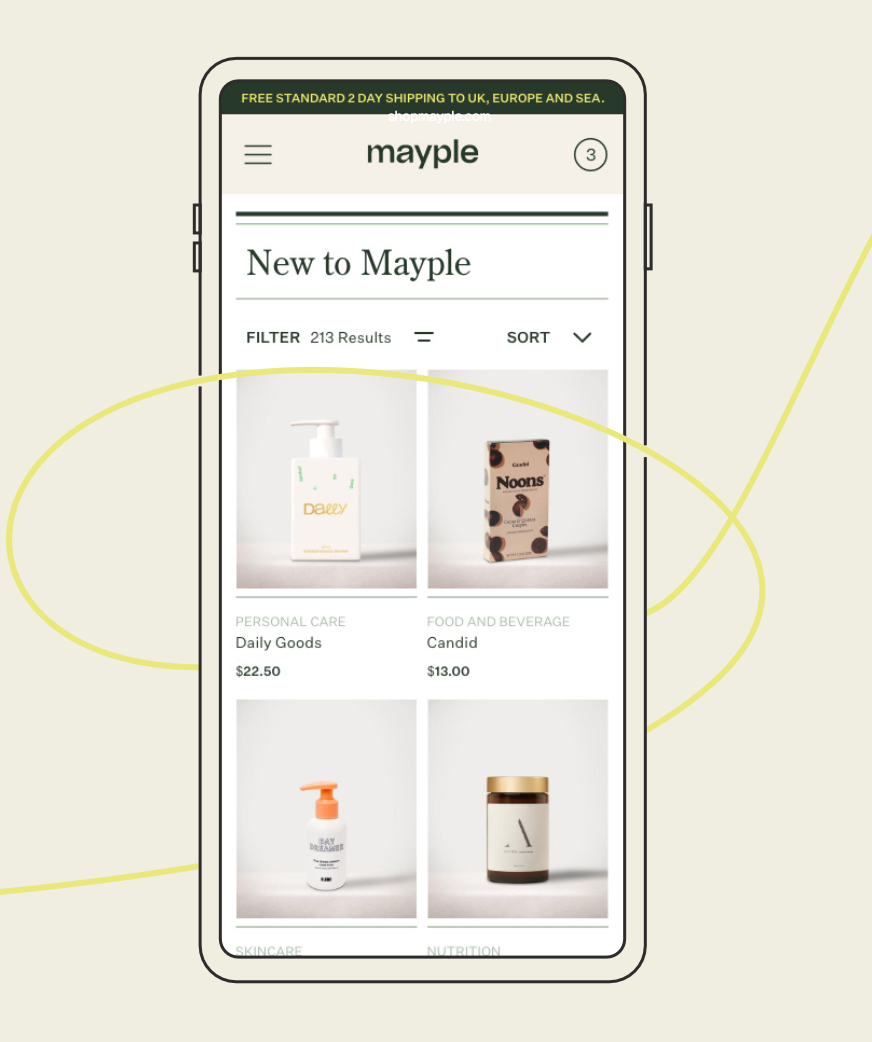

To make international expansion workable for DTC startups, Moiz along with his wife and restauranteur Mishali Sanghani dreamed up the idea for Mayple as a digital marketplace and vehicle for getting products into the hands of consumers around the world. Soft-launched last month, Mayple carries nearly 40 personal care, skincare, haircare, feminine care, nutrition and home brands that it describes as ethical, effective and brag-worthy in its assortment, including Dally, Masami, Aer, Amass, Kin, Blume, Twice, Arithmos, Plenaire, Keeko and Wholy Dose.

Mayple co-founder Ammar Moiz

Mayple co-founder Ammar Moiz

“I was enamored by the Farfetch business model. I thought it provided a win-win for consumers and brands, and created real business value,” says Moiz. “That is the business model we operate as well. We are a marketplace that cuts out the middleman. It offers greater margin to the brands and better pricing to the customers.”

Brands commit inventory to Mayple on a consignment basis. Moiz and Sanghani have designed it to be affordable to nascent brands. On average currently, Moiz says brands are committing $5,000 to $10,000 worth of inventory to Mayple. As it matures, the plan is for Mayple to assist brands with data-driven forecasting insights grounded in the demand it’s tracked in various countries. The platform commands a cut of sales ranging from 35% to 42%. To ensure brands adhere to local regulations, Mayple doesn’t make them available in jurisdictions in which they’re not compliant.

“I was enamored by the Farfetch business model. I thought it provided a win-win for consumers and brands.”

In the United States, brands available on Mayple ship products to New Jersey, and Mayple picks up the shipping cost from there to Dubai, where it has an agreement with a distribution center that’s a five- to 10- minute drive from the airport in a free-trade zone. Mayple ships to over 50 countries across Asia, Europe and the Middle East. So far, customers from about 14 countries have purchased products on Mayple. It’s looking to enable deliveries to India and China by the fourth quarter of this year. In the future, it intends to sell brands headquartered outside the U.S. to American consumers.

Mayple charges consumers a $12 flat-rate shipping fee for purchases under $80. Shipping is complimentary on purchases above $80. Customers receive shipments from Mayple in two to five business days. It has a relationship with DHL, and the international courier has a deal with the airline Emirates to facilitate speedy deliveries. Product prices on Mayple largely stick closely to U.S. product prices, according to Moiz. Currency fluctuations, however, could affect prices, and the value-added tax or VAT is incorporated into pricing in countries that levy it.

Soft-launched last month, Mayple carries nearly 40 personal care, skincare, haircare, feminine care, nutrition and home brands, including Dally, Masami, Aer, Amass, Kin, Blume, Twice, Arithmos, Plenaire, Keeko and Wholy Dose.

Soft-launched last month, Mayple carries nearly 40 personal care, skincare, haircare, feminine care, nutrition and home brands, including Dally, Masami, Aer, Amass, Kin, Blume, Twice, Arithmos, Plenaire, Keeko and Wholy Dose.

For DTC brands, Moiz elaborates, “The problem we essentially solve is international shipping is expensive, and there is a long lead time. So, if there is a brand in California that somebody in Australia wants to purchase, the shipping time and cost is complicated and expensive. It’s a cost that a brand can take on or sometimes a consumer can take on if they really want a product, but the goal of Mayple is to offer global distribution to a lot of brands regardless of size. Even brands that do sub-$1 million in sales—and we have brands that do way more than that—can access the global market.”

Leah Shamouni, director of partnerships at Mayple, says the platform concentrates on brands that are mission-centered and pay attention to sustainability. “We are really bringing the wellness lifestyle overseas,” she asserts. While Mayple expects to increase the number of brands in its selection (baby and pet product brands are good possibilities), Moiz emphasizes it tries not to “overburden consumers with choice.” The brands are presented on a website created with brand strategy agency Farrynheight to suit DTC aesthetics. Moiz says, “We are very much focused on next-generation brands that are solving problems for consumers that old-world consumer brands aren’t.”

“We are really bringing the wellness lifestyle overseas.”

Lynn Power, co-founder and CEO of Masami, a haircare brand that launched in February last year, says, “It’s a no-brainer for us as a small brand because Mayple has made it turnkey…They handle the logistics and fulfillment. It’s a great way to reach a new audience on a platform that is about conscious consumerism. We also love that they vet and curate the brands, and that they focus on wellness, so it feels like we’re in good company.”

Elizabeth Egan, co-founder of the less than year-old hand wash line Dally, says, “Since we launched, we have seen incredible international demand for Dally, but aren’t ready to expand our operations outside of the U.S, yet. When Mayple approached us, we thought it might be too good to be true! Mayple allows us to reach international customers without having to change our operations.”

Mayple co-founder Mishali Sanghani

Mayple co-founder Mishali Sanghani

Mayple has raised an undisclosed amount in friends and family funding, and is pursuing pre-seed funding now. Asked about a revenue projection for its first year in business, Moiz responds that it’s a “moving target.” Mayple has yet to prime the digital marketing pump and, particularly amid the ongoing pandemic, consumers’ appetite and ability to spend is uncertain. However, Moiz points out the pandemic has amplified global consumers’ willingness to shop online—he notes anxiety about inputting credit card information was a bigger hurdle prior to the pandemic—and the international infrastructure for last-mile delivery has strengthened.

“For our first year, we are very much focused on unit economics. We believe that is pretty important to get right and that will have great long-term benefits in terms of cash flow,” says Moiz. “If the unit economics look good as we grow and scale, it’s a question of adding more fuel. I think we have pretty ambitious targets in terms of what the global opportunity looks like in the categories we are in.”

Source link : https://www.beautyindependent.com/dtc-brands-mayple-taking-around-the-world