The behind-the-scenes greening of beauty factories has gone largely unnoticed. Voyant Beauty wants to change that. In a first for large-scale beauty manufacturer in the United States, the company has undergone an environmental, social and governance (ESG) review identifying six areas (climate change, product quality and safety, product lifecycle management, sustainable ingredients, diversity and inclusion, and talent management) it will track to encourage constant improvement. The plan is to release annual progress reports to show how Voyant Beauty is advancing in the six areas—and how it could stand to advance even more. It’s already cultivating upcycling, waterless, concentrated and bio-based formulation ideas; offering sustainable packaging upgrades to brands such as dissolvable pod technology that reduces plastic waste; and implementing a chemical policy to phase out chemicals of concern and develop safer alternatives. “The whole purpose of the ESG journey is to take an honest inventory of what we are doing already that we can celebrate and amplify, and what is missing or what gaps do we have, not only from an internal standpoint, but with our key stakeholders externally,” says Lorne Lucree, chief innovation officer at Voyant Beauty. The size of Voyant Beauty means its efforts can have a considerable impact on the beauty industry as a whole. Owned by private equity firm Wind Point Partners and the result of acquisitions of the manufacturers Vee Pak, KIK Personal Care, Aware Products and Cosmetic Essence Innovations, it’s the biggest beauty manufacturer in North America in terms of capacity. Voyant Beauty has over 3 billion units of capacity, 5 million square feet of space across 14 manufacturing facilities, 270 filling lines and 4,000 employees. Beauty Independent spoke to Richard McEvoy, its CEO, and Lucree about the ESG process, supply chain chaos, beauty product price increases, clean beauty’s future and the rise of “niche-tige” beauty.

Can you tell us a little about what makes Voyant Beauty different?

Lucree: When we think about the contract manufacturing industry overall—I came from the brand side where I worked with over 40 contract manufacturers—the struggle was you’d find an innovative manufacturer, but it lacked the capacity, and you couldn’t get to market quickly. Or, on the other side, the large manufacturers had little to no innovation expertise. They had a ton of capacity to fill what you wanted, but they lacked that experimentation. We have a really well-built-out innovation engine, leveraging AI, machine learning, social media listening and Google analytics, and we have the ability to scale. We can do everything from a 5,000-unit run that a fast-growth indie would want to run until they get scale all the way up to 100,000- to 200,000-unit runs and everything in between. We feel that is unique within the world of contract manufacturing.

Why did you decide to undergo the ESG process?

Lucree: The journey was interesting. It was started last December. We did a materiality analysis. There is a multitude of issues related to environmental, social and governance, and you could try to test all of them, but you are going to try to boil the ocean and not do anything. What the materiality analysis does is that it utilizes input externality to identify what is most important. For some customers, sustainability is critical to them. For others, it’s how we are treating employees. It really differs. Everything plugs into a magic algorithm that attaches importance to them. It helped us narrow the focus to the six critical areas. We mapped out a roadmap across the six topics we defined.

We are being very open and transparent that we want to meet customer needs around key manufacturing processes. The whole purpose is to align our values with theirs. What we are seeing from customers that they have ben surprised and delighted that we have undertaken our journey. I had a call this morning with a blue-chip customer really excited to partner with us and tell the story of how they are working with us to optimize water and waste usage. With Clean +, Sephora is really encouraging brands to think about the entire supply chain, not only formula and packaging, but also manufacturing. We are helping them understand the amount of carbon and water going into manufacturing.

To be quite transparent, one of the biggest challenges was aligning all of our four acquisitions around a common strategy and figuring out the details of how to get there within the timeframe we want. It’s less so about the practices, but more so about how we are capturing data given our breadth and size now, and making sure the data is actionable.

Lorne Lucree, chief innovation officer at Voyant Beauty

Lorne Lucree, chief innovation officer at Voyant Beauty

What do you see as the next big focuses when it comes to sustainable and ethical beauty?

Lucree: It’s really about understanding every facet of the formulation. Every facet of making the product is going to be scrutinized or amplified. For a very long time, raw materials and packaging were the focuses. Now, it’s broadening in manufacturing. We spoke about energy and water usage, and I think we are going to start to see it deepening around the approach to formulation, the amount of ingredients being used, the manufacturing instructions, and the different types of processing that use less water and energy. That’s why we are so excited for our ESG plan to be in place because it allows us visibility.

What kinds of beauty brands do you see emerging?

Lucree: What we are seeing is what we call “niche-tige,” which is this approach of one-size-fits-all does not fit all. It’s brands like Bodewell and Hiki. We call it magic on the margin. We saw this trend in television with shows like “RuPaul’s Drag Race.” Ten years ago, not everybody would know about it, but, now, everybody does. When something speaks to a specific concern or customer, it can be successful.

How are you responding to global supply chain disruption?

McEvoy: It’s very real, and it is across the board to be honest. It’s raw materials. It’s packaging. It’s freight and, in many facilities, it’s people, whether it’s because of COVID or people being taken out of the workforce in the past 12 months. The key thing we are doing is leveraging our network. Sometimes, we may have challenges in one location. So, we can move things from one facility to another. The second thing is we work on trying to find alternatives, whether it’s packaging or raw materials, so they are not single-sourced. The other thing, which is very basic, is close communication. The supply chain doesn’t work like it used to, and you have to face that reality now and manage to it.

Richard McEvoy, CEO of Voyant Beauty mikeriveraphoto.com

Richard McEvoy, CEO of Voyant Beauty mikeriveraphoto.com

What do you think will be lasting impacts from the pandemic?

McEvoy: I think the things that will last are resilience, flexibility, the importance of having your own full-time employees, and building the culture of recognition, talent and diversity. I think that has really helped us in this period. We have a high proportion of full-time employees. They were less affected than temporary employees. Obviously, with the labor shortage, everybody is going to be looking for, how can you automate more? And what is the role of automation? I think one of the side benefits of missing the face-to-face contact with clients is that, in some ways, things have sped up more. You can jump on Teams every day with them. We were always in a fast industry, but it’s gotten even faster.

What do you think could be done to improve the manufacturing sector in the United States?

McEvoy: I think the manufacturing sector in the United States is fundamentally a strong sector. In my mind, it’s a powerhouse to the economy of the United States. I have that vantage point because I’m originally English. I saw a lot of manufacturing move out of the U.K. and to continental Europe. Whilst there has been outsourcing in the U.S. as part of the global supply chain, by and large, manufacturing is valued and a lot of talent resides in it.

The pandemic is going to challenge companies to think even more about to what extent to they go global with some of their supply chain as lead times have extended from certain regions. Everybody is more focused on scarcity of supply. Cost is very important, but, if you can’t get the product at all, that’s the biggest issue. I think people are going to be focused very much in the future about how do we secure supply. Having capabilities in the United States is going to be a very strong positive.

We need to address the labor situation. I think we are heading to a labor shortage in the future full stop. I know that the government has some good Visa programs where migrant workers can come for certain periods. That’s going to have to be extended. The pandemic has caused so much disruption, but I don’t think it’s fundamentally broken, though.

Do you think we are going to see a wave of beauty product prices increases?

McEvoy: Yes, absolutely. A lot of manufacturing is not running as efficiently as it was. There has been labor inflation because there is a shortage of people, but, on top of that, because the supply chain isn’t working as well, you are not as efficient as you were a year ago. You are not as efficient, and you are spending more. You have seen raw material, freight and labor inflation, and that’s obviously going to cause a spike in price increases. There is no way around it.

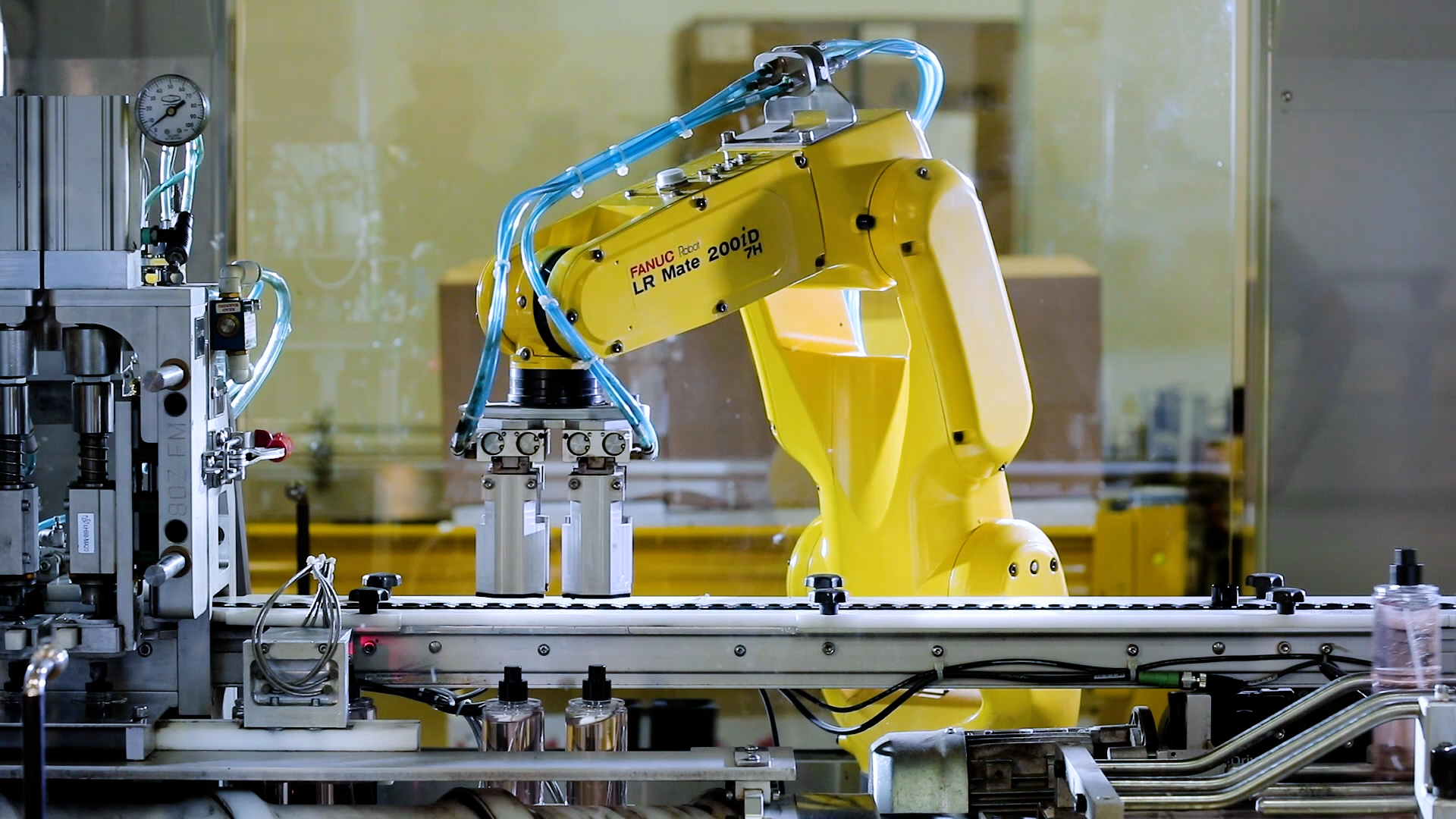

Owned by private equity firm Wind Point Partners, Voyant Beauty resulted from acquisitions of the beauty manufacturers Vee Pak, KIK Personal Care, Aware Products and Cosmetic Essence Innovations.

Owned by private equity firm Wind Point Partners, Voyant Beauty resulted from acquisitions of the beauty manufacturers Vee Pak, KIK Personal Care, Aware Products and Cosmetic Essence Innovations.

The pandemic didn’t seem to slow down the number of new beauty brands, but it impacted product launches. What did you see happen?

Lucree: COVID did an interesting thing we observed of causing everybody’s marketing calendars to be thrown out the window. We saw the slowdown launch to launch and more thoughtful planning about what you are launching. It had to make a big splash because you were mostly competing only on social to break through. So, product had to be really special and really a hero product. It had to be ownable by the brand. It wasn’t just another launching another vitamin C product to launch another vitamin C product.

While we haven’t seen brands slow, I think the days of launching with a 20-SKU line are gone. You are going to launch with four SKUs tops and expand from there. I think it’s less about gaps in the marketplace than finding a credible, authentic approach that will help you break through and the partners that can bring your story to life to complement that.

What innovations do you see coming down the pike?

Lucree: It’s really sustainability first and foremost. Not so much sustainability to add a buzzword, but true, committed sustainability. You have seen some of the backlash around PCR [post-consumer recycled] content. Consumers are smart, and they are going to pick apart what you are saying and really question it.

You are seeing things like concentrates and powders. They are moving in the right direction, but whether folks will adopt them is an open question. Our consumer testing showed is that, unless there is a true performance improvement, you aren’t going to get people to switch from products like shampoos, cleansers and serums. For body washes or hand washes, they were potentially open to switching and trying. The question is: How do you make those formats relevant and compelling now to encourage adoption versus press interest?

It’s a habit shift. Using a powdered face wash is not as easy as pumping out face wash in your hand. A paste is a different experience, and you have to educate the consumer on that. It’s going to take time to gain traction.

Where do you see clean beauty heading?

Lucree: I think there is a lot of confusion and a lot of it is marketing-driven. What is it and what isn’t it? It’s about taking a step back and understanding functionality. There’s going to be a reckoning around this because there definitely is a place for organic, but there is a place for high-performance raw materials that are used in a way that is sustainable and speak to clean positioning, too. Beyond that, clean beauty is going to move beyond just what’s in or isn’t in the juice to the whole picture. It’s about the way the formula is made, the way it’s manufactured, the packaging, all these things are part of the total story and proposition.

Voyant Beauty has over 3 billion units of capacity, 5 million square feet of space across 14 manufacturing facilities, 270 filling lines and 4,000 employees. In terms of capacity, it’s the largest beauty manufacturer in North America.

Voyant Beauty has over 3 billion units of capacity, 5 million square feet of space across 14 manufacturing facilities, 270 filling lines and 4,000 employees. In terms of capacity, it’s the largest beauty manufacturer in North America.

What are some goals for Voyant Beauty?

Lucree: Delivering on our initial ESG promises and rolling this out across the company. We are leveraging our entire network to deliver on our five-year roadmap. It’s going to be a very heavy lift, but one we are excited about. From an innovation standpoint, it’s about creating a tailored approach to how we are working with brands. We have built out our upfront innovation engine, but the goal over the next year is to figure out how we can provide a custom service model to suit specific brand needs. If you are a fast-growing indie brand, what does that mean for what you need versus one of our larger clients? What’s similar and what’s different, and how do we carve those out to make a really robust R&D service?

Source link : https://www.beautyindependent.com/beauty-serious-sustainability-contract-manufacturers-commit-voyant-beauty