World gold prices turned down in the session of January 3. Chart: Kitco

The Dollar Index - which measures the greenback's strength against a basket of major currencies - has just recorded its strongest weekly gain since mid-November. The stronger USD makes gold more expensive for buyers outside the US.

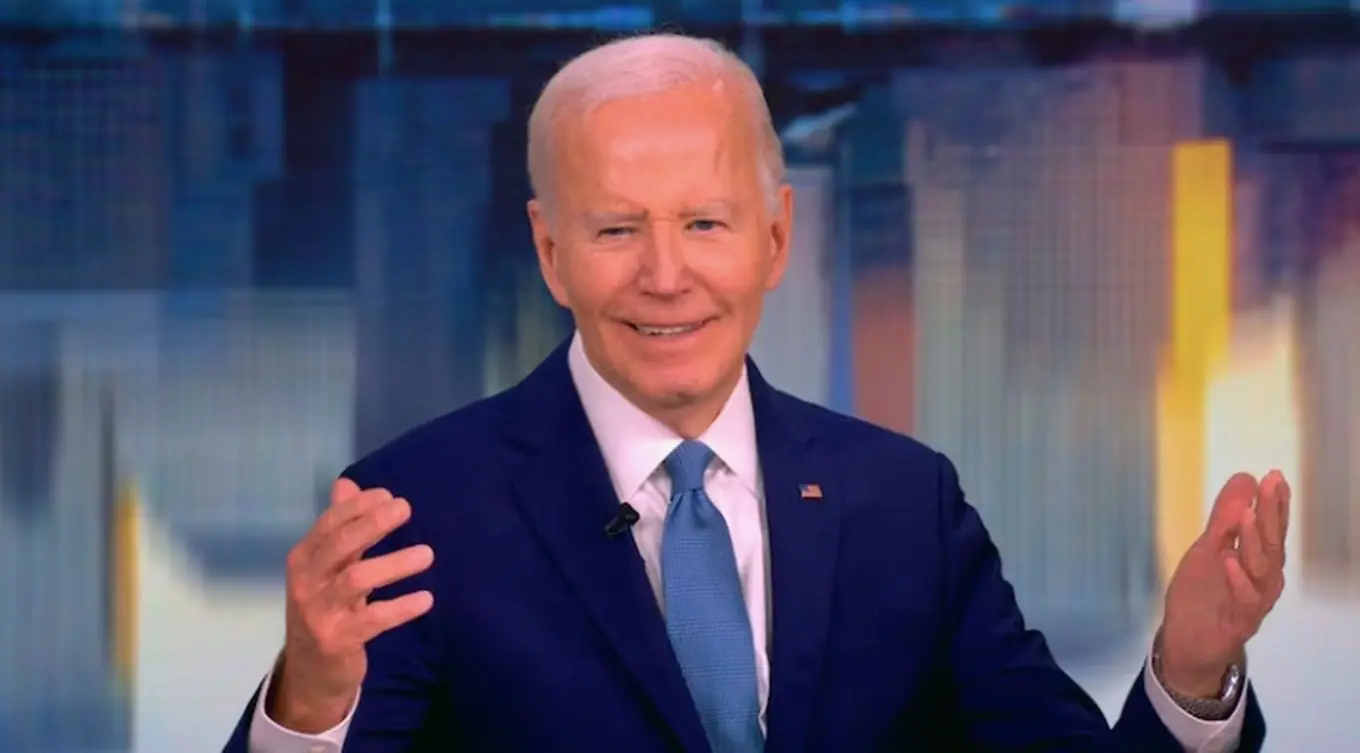

"Global trade flows and economic activity will slow down the demand for precious metals," Shah said, referring to the impact of Mr. Trump's import tariffs.

However, precious metals still have many supporting factors. That is the high public debt in the US and many other countries. Geopolitical issues are also unlikely to end soon.

On January 20, Mr. Trump will be inaugurated as US President. His protectionist policies are expected to fuel inflation, slowing the US Federal Reserve's monetary easing process, thereby limiting the increase in gold prices. After 3 interest rate cuts in 2024, the Fed forecasts only 2 rate cuts this year.

However, in the first month of the year, gold prices usually perform well. "January has typically seen strong gains over the past 20 years, driven by investors opening new positions and holiday jewelry demand," said Ross Norman, an independent precious metals analyst.

In contrast to gold, other precious metals rose on January 3. Silver rose 0.2% to $29.60. Platinum rose 1.9% to $940 and palladium rose 1.7% to close at $926.